Making paid search efficient

High CAC, 2nd order effects, and making the inefficient efficient

After 10+ years of bootstrapped growth, our founders decided it was time to hit the gas pedal and take over the market by taking on a hefty PE investment.

We all know that with investments come growth expectations, often equally as hefty. That’s why the PE/VC playbook in the early 2020s was growth at any cost, but recent years have forced them to rethink that strategy.

So as I’ve been heads down the past few weeks in updated planning mode, there’s been one hypothesis swirling around in my head that I haven’t been able to find data or examples that validate/reject it:

Is there a way to take historically inefficient CAC channels like paid search and, by looking at the 2nd and 3rd order effects opportunities of those, make them more efficient?

Sponsor: Default

We’ve come a long way since the days of “A member of our team will be in touch within the next 72 hours” upon a prospect submitting a demo request on a website. Automating the back + forth scheduling so the prospect could pick the date + time for their call upon form completion was a huge step forward.

And now we’re seeing the next one.

Default is levelling this up for organizations by going not just one, but multiple steps beyond this by looking at the overall job to be done and solving for that. So instead of stopping at helping the prospect pick a date + time for the call, here are just a few additional things Default is automating for teams:

Automatic enrichment of the lead + company with information relevant to you

Automatic qualification/disqualification based on pre-determined criteria

Automatically create leads, contacts, activities, and even opportunities within your CRM with the correct info appended

They gave me a sneak peek at what’s coming over the next few months as well, and I’ve got to say, I’m impressed and already working on migrating over to them.

Backstory: paid search

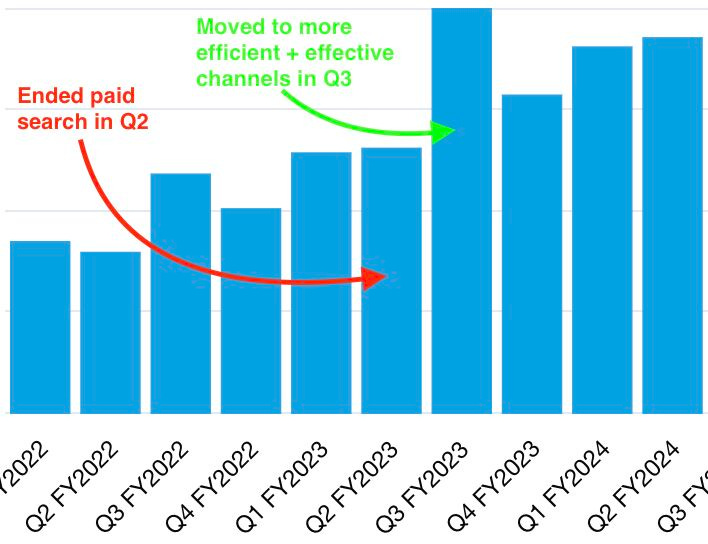

If you’ve been following along with me for some time, you’ll know I have strong feelings about paid search. In fact, in 2023 I ended all of our paid search campaigns + spend. This wasn’t because the channel “didn’t work,” but it was simply a function of math.

Paid search is a demand capture/last touch-oriented marketing effort, so through UTMs and tracking scripts, it’s easy to see how those keyword investments pan out not just at the cost per conversion level, but all the way through customer acquisition cost (CAC).

After performing the analysis, I found:

- Only 2 keywords had < 12 month ad CAC payback (both were branded terms)

- 70% of the new customers from paid search came in through branded terms, but the ad CAC payback was > 12 months

- 30% of the new customers from paid search came in through non-branded terms (one term was more efficient than branded, but still > 12-month payback)

- There was no strong correlation between paid search spend and Direct/Organic traffic OR total volume of high-intent handraisers

(Side note: if you’re interested in doing your own analysis, here’s an in-depth article I wrote about how you can do it + a template to use)

So I went to our CEO and said we're ending paid search, here's why, and here are 3 options to better utilize that budget given that we’re bootstrapped and have to determine the best way to make every dollar go as far as possible for us. We made the shift and our hypothesis was validated.

Fast forward to today - I’m revisiting paid search

I do my best to try to avoid making “always” or “never” statements. Too many things are changing to be able to say something will “always” or “never” work. And more often than not, it’s not that a channel isn’t working, it’s that the playbook being used on it is what’s causing the issue.

Preamble aside, I’m back to looking at paid search as an acquisition channel.

I turned paid search off in 2023 because I had a limited budget. I could only spend so much per quarter across any number of channels, so I had to put my dollars into the ecosystem inputs that resulted in the lowest CAC payback period. But now things have changed. My budget is larger and our targets are larger. And not only larger, but there are dates we need to be hitting pipeline and revenue milestones by.

Enter: paid search.

Although more inefficient, when configured correctly, it’s a great way to capture existing buyers who are “problem aware / solution unaware.” Our overall marketing strategy is designed to make sure our ICP rarely falls into any bucket that would have them “solution unaware,” but we serve a massive ICP and haven’t been able to saturate them with our limited budget before. So this means there’s an opportunity for us here.

Is it possible to make paid search efficient?

If we could rewind back to the late 2000s/early 2010s, then yes, it absolutely is possible.

Sarcasm aside, this is the hardest part of solving for paid search. It’s been seen as a trade-off. “Easier” revenue capture, but at a more expensive price point, so you better have strong retention or long contracts to make sure you’re profitable off any customers acquired here.

But what if it didn’t have to be a trade-off? What if we proactively created a system + playbook for customers acquired via this channel to create a flywheel?

Our strongest growth driver is word of mouth, and by a longshot. So what if we proactively created a system and playbook focusing specifically on customers acquired via paid search to make them want to tell their peers and others in the space about their experience with us? Since the “ad CAC” on any customers acquired via word of mouth is $0, could we look at these as second- and third-order effects opportunities that would make that first-order acquisition well worth the investment?

A lot of word theory above, so let’s hop over to my handy dandy notebook to simplify what I mean.

(Note: everything that follows is hypothetical and the data used is made up for educational purposes)

Example: Hubspot

Let’s say we’re marketing for Hubspot. We want to acquire more customers for our Sales CRM. So we look to paid search and start putting ad dollars there behind high-intent keywords such as “Best sales CRM”, “Sales CRM for SaaS”, and “Salesforce alternative”.

To keep this simple, here are the definitions + assumptions we’re using:

CPC = cost per click (how much does 1 click cost on Google)

CPL = cost per lead (how much does 1 conversion cost on Google)

Cost/opp = cost per sales qualified opportunity

Ad CAC = variable advertising spend customer acquisition cost (how much does it cost to acquire a customer from an ad spend only level)

Ad CAC payback = variable advertising spend customer acquisition cost payback period (how long will it take to recoup the investment to acquire the customer)

5% click to lead conversion rate

10% lead to sales qualified opportunity conversion rate

25% sales qualified opportunity to closed won conversion rate

$25,000 ACV (annual contract value)

And now for how this would play out…

As you can see, paid search is expensive, especially once you look past the “low” cost per leads most ad agencies try to sell you on and look at acquisition costs. But I digress, that’s not what I’m here to get on a soapbox about.

Let’s say we landed on the above keywords due to their high-intent nature and that we saw they drove customers for us previously. What I would do next is go and look at customers who came in via those keywords 1, 2, 3, etc. years ago and see if they’re still customers. Why? Two reasons:

See if you ever were profitable from an ad CAC payback on them (better hope they stayed past a year!)

Note: I strongly recommend you don’t stop at ad CAC and ad CAC payback period and go on to account for the entire GTM overhead to get a true picture for the cost to acquire a customer for your organization

See if any are truly great customers that have renewed multiple times AND have something like a high NPS score

You may find some correlations in those findings between keywords that have led to great customers and keywords that brought in customers who churned. This is a feedback loop you’ll want to bake into how you iterate on your paid search plan. But more importantly, let’s rabbithole on those truly great customers as that’s where our flywheel is about to begin.

The flywheel

Let’s say that the first two keywords ended up being keywords that led to countless customers who have renewed multiple times and have phenomenal NPS scores with you. The initial ad CAC payback periods for those were 19.2 months and 15.4 months, not exactly great numbers.

And let’s say the last keyword, “Salesforce alternative,” despite having the lowest ad CAC payback period of 11.5 months, ended up having a significantly higher amount of churn due to many of those customers simply jumping between CRMs every 18-24 months in search of the lowest priced CRM they could find.

We’ll want to focus on the first two keywords here and craft a system that surfaces those customers in the appropriate places and at the appropriate times to try to maximize their likelihood of spreading positive word of mouth about us. Bonus points occur when the customer initially acquired is a well-known logo or a trusted voice within the ICP you sell to.

Going back to the handy dandy notebook, here’s where my hypothesis becomes much easier to understand.

Instead of viewing the customer initially acquired at a 19.2 month payback period as a cost, we view them as an investment. If we can get them to use positive word of mouth to drive $0 acquisition cost customers for us, then, we run a play that steals a term from the investment industry of “averaging down” by buying more shares of a stock when the price drops. These are the second-order effects opportunities.

So that first customer ends up bringing 3 additional customers our way via word of mouth. One is a peer they know. One came to us after seeing them post about us on social media. One came to us that used us at the initial company, but since moved to a new role at a company in the same ICP and they championed bringing us on.

And just like that we now have 4 paying customers from that initial investment. And that 19.2 month payback period has become a 4.8 month payback period.

Then we run the same system + playbook on those 3 customers. One of them drives another new customer our way. One of them drives 2 more customers our way. And one of them doesn’t drive any additional customers our way. We have 3 more new customers from this “second-order” group, bringing our grand total to 7 paying customers from that initial investment. And that 19.2 month payback period that became a 4.8 month payback period has now become a 2.7 month payback period. These are the third-order effects opportunities.

Conclusion

I still don’t love paid search as an acquisition channel due to the overall costs. But hey, you know what they say about when life gives you lemons…you make the most efficient lemonade as possible.

Book quote of the week

I’m getting back into a good rhythm of reading now that our little one has been on a regular schedule + I’ve moved mine around to carve this reading time back out for myself. So each week I’ll grab a quote from a book I recently read that gave me pause, whether as inspiration, motivation, or a good thing to think deeply about.

“You have had a very fortunate career. You are at the parting of the ways. Will you take the easier course, the way of least resistance…or will you take the more courageous course and, risking much, achieve much?”

- The Bully Pulpit by Doris Kearns Goodwin

In case you missed these this week

See you next Saturday,

Sam